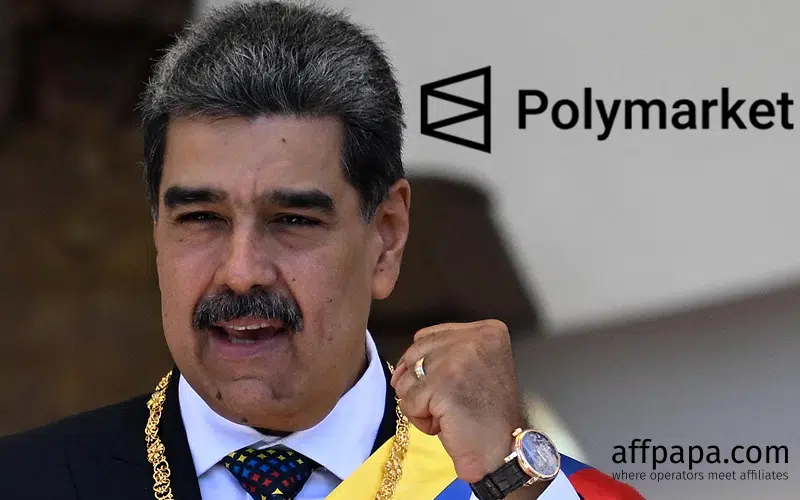

Maduro trade on Polymarket triggers insider trading bill

An unidentified trader invested more than $34,000 in event contracts predicting the capture of Venezuelan President Nicolas Maduro and generated a return of over $430,000 on Polymarket, causing officials to introduce an insider trading bill.

The first bet was placed on December 27, 2025, after which trades steadily increased on Maduro’s removal. The account was opened at some point during December 2025, and the last trade took place just hours before Maduro was captured and had a probability below 10%.

This sequence of events triggered concerns about insider trading, as New York Congressman Ritchie Torres is now introducing a bill to ban insider trading on prediction markets.

The bill, called the Public Integrity in Financial Prediction Markets Act, will make it illegal to engage in a financial transaction if a person possesses information about the trade that is not already available to the public. This will extend to political appointees, elected officials of the federal government, or employees of an executive agency.

As of January 6, 2026, Polymarket offered over 30 event contracts on the South American political environment. On the same day, the “yes” option on the prediction that the US will invade Venezuela by March 31, 2026, traded for 14 cents.

With a degree in politics & governance, research and writing has always been a strong side of mine. With AffPapa, I use my skills to present to the reader the latest news, articles, as well as interviews with industry representatives from the iGaming sphere in the most exciting but at the same time informative manner.