iGaming in Mexico: Top 5 traffic sources in 2026

PIN-UP Partners provide guidance on what to test, taking into account the local specifics and nuances of each GEO.

Recently, the company highlighted a successful case showing that Mexico remains one of the most profitable GEOs in LatAm when the right traffic sources are used. In that campaign, a careful choice of sources helped a partner generate $213,604 in net profit and 23,774 FTDs over just three months (full case via the link).

PIN-UP’s analytics team and in-house media buyers track the market daily, identifying which sources are performing best and sharing these insights with partners. This article presents the top five traffic sources that deliver real profit in Mexico and are expected to remain strong into 2026.

TOP-5 traffic sources for Mexico

The article highlights five key channels: Google Ads (UAC), SEO, Facebook, In-App, and ASO. These are the sources that generate the highest deposit volumes and the most consistent traffic quality. They form the core toolkit for any affiliate looking to scale campaigns in Mexico or maintain strong profits in this GEO.

Google Ads (UAC)

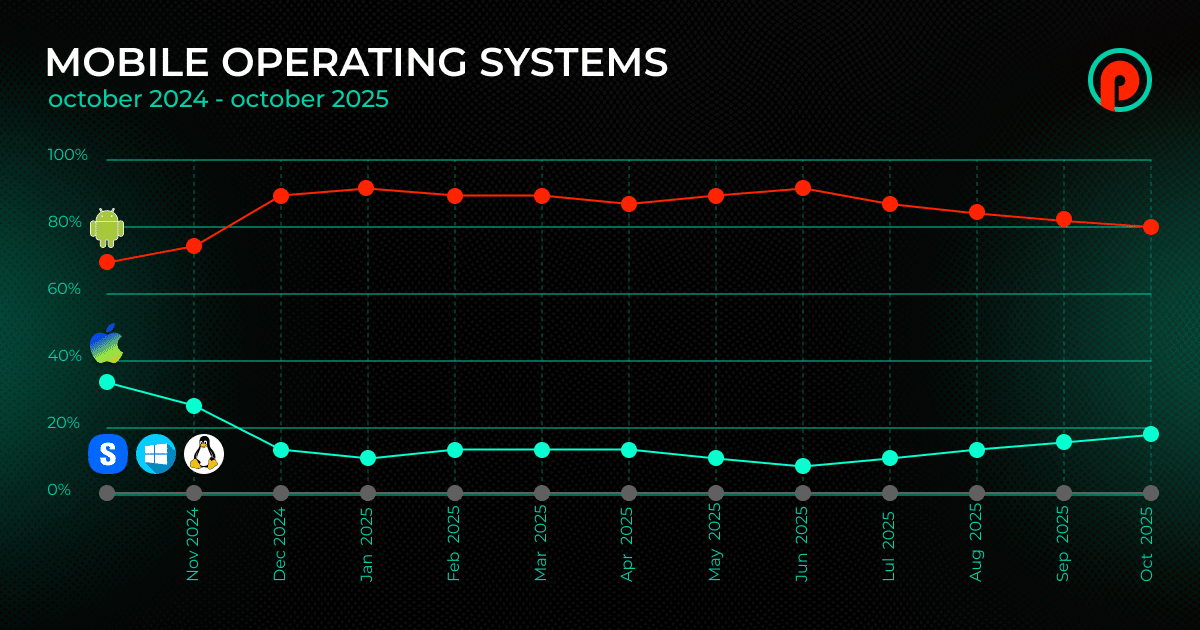

Google Ads in Mexico is a vast ecosystem that captures nearly all mobile — and much of the general — internet traffic in the country. With around 81% of smartphones running Android and 98% of mobile searches happening on Google, using UAC gives affiliates a major advantage: the platform tracks user behavior across many touchpoints, understands intent, and reaches an audience that is already close to making a deposit.

Unlike social networks, where many clicks come from curiosity or emotions, Google traffic is based on clear behavioral patterns. Users search, compare, and read about bonuses or specific games before they even reach a UAC campaign. That’s why UAC delivers a steady flow of “warm” players and often attracts a user base with higher lifetime value; Internal data shows it can outperform social traffic by 40–60%.

The strength of UAC is its ability to optimize for deep-funnel events. When an offer generates quality signals (like registrations, deposits, or Reg2Dep) the algorithm starts finding users similar to those who have already paid. This is a crucial step in the case of Mexico, a country where online gambling is becoming more and more lucrative (currently worth $1.6 billion and projected to be $3.1 billion by 2030) and the competition is constantly increasing.

The biggest profits go to those who bring the most qualified traffic. UAC excels here because it combines Search, Discover, YouTube, apps, and contextual placements into one stream, targeting people who are ready to make their first deposit.

Affiliates also favor UAC in Mexico because it drives higher engagement and click-through rates. Globally, the average CTR for search ads is around 6.4%, but in iGaming it tends to be higher since users are already in the decision-making stage. UAC picks up on these signals and scales them across mobile, producing better-quality clicks and more consistent conversions. When the landing page matches user expectations, conversion rates in Google Ads can approach 7%, and in iGaming they can go even higher if bonuses and landing pages align with player intent.

Google Ads attracts quality visitors that have a longer retention than average, this is the reason why UAC is the major traffic source for affiliates entering the market or looking to keep FTDs stable and get predictable performance in a long-term basis.

SEO

SEO remains the most important long-term traffic source for Mexico. It brings a steady flow of users and keeps positions stable even when competition heats up. The main advantage is simple: a predictable stream of players who arrive with trust and a clear intention to take action.

Mexican players tend to search on Google before choosing a casino or betting platform. They compare bonuses, check legitimacy, and evaluate trustworthiness. That’s why review sites, ratings, and comparison articles consistently attract high-intent traffic.

Competition for core iGaming keywords in Mexico has increased noticeably in 2024–2025. Large international aggregator sites have launched dedicated Mexico sections, while local websites are catching up quickly. Google also favors .mx domains and content tailored specifically for the Mexican market.

Top positions for keywords like “mejores casinos en línea México” or “casas de apuestas deportivas México” are already held by 5–10 strong domains with high-quality content and solid link profiles.

But there’s still a huge layer of so-called underdeveloped opportunities:

- Long-tail queries: ratings, niche categories, no-deposit bonuses, specific features

- State-based searches: “casinos Nuevo León,” “casas de apuestas Puebla,” “bonos Querétaro”

- New and emerging topics: crypto betting, operator reviews with USDT/bitcoin support, local sports events, seasonal holidays, regional tournaments

- High-level localization: content written in real Mexican Spanish with mentions of local payment methods (OXXO, SPEI), local slang, and popular games

PIN-UP Partners handles full localization for affiliates. All content, landing pages, and creatives are reviewed by native speakers, ensuring materials feel natural for the Mexican audience and perform as if produced locally. Affiliates planning to run campaigns in Mexico can join PIN-UP Partners, and the team will take care of all adaptations.

Organic traffic in casinos & betting platforms converts very well. Results vary depending on site quality and audience, but players acquired through SEO typically show higher lifetime value and lower acquisition costs compared to paid traffic.

FB (Meta)

Facebook has been Mexico’s leading social platform for years, reaching up to 86% of the population. Among the most economically active age group (18–40), penetration is nearly total, making it a key entry point for iGaming affiliates targeting players with both the interest and financial means to engage in online entertainment.

According to the Mexico Social Commerce Market Intelligence Report 2025–2030, over 90% of social-commerce purchases take place on Facebook. Users accustomed to spending inside the platform find it natural to move from an ad to a gambling product, shortening the funnel, increasing trust, and maintaining strong conversion rates.

In Mexico, the majority of digital interactions are carried out through smartphones, and the Meta algorithm is effective in optimizing based on mobile engagement signals which include clicks, likes, rewatches, and interest in football or betting-related content. Football is a national passion, so campaigns that tap into this enthusiasm perform especially well.

Mexican audiences respond strongly to emotional storytelling—thrill of winning, player reactions, game animations, and instant rewards. Before Liga MX matches, particularly Clásico Nacional, CTRs can rise 30–50%, offering affiliates an opportunity to reduce CPC and reach audiences at a lower cost.

With sufficient testing and budget, Facebook is a powerful tool for affiliates looking for broad reach in Mexico. The main challenge remains navigating Meta’s strict moderation rules.

In-App

Mobile traffic has become the backbone of Mexico’s iGaming market. Mordor Intelligence reports that nearly 64% of all online bets now come from mobile devices, and the segment is growing at about 18% per year, with strong dominance expected at least until 2030. Mexico is also one of the most Android-heavy markets in Latin America.

For affiliates, this means most In-App ad traffic will come from Android devices, giving access to a market of over 105 million people. But in mobile advertising, sheer volume isn’t enough. The quality of inventory matters just as much—banner formats, native placements, video ads, and interactive creatives all impact whether impressions are actually seen.

According to Pixalate’s Q1 2025 report, only about half of all In-App ads are actually viewable. For affiliates, this highlights the need to carefully select networks, optimize placements, test formats, and use transparent DSPs that allow filtering out low-quality or “junk” publishers.

In Mexico, In-App advertising works particularly well for affiliates looking to scale or test performance because it offers:

Access to the largest mass mobile audience

Cheap, fast, and predictable inventory

Lower install costs thanks to Android dominance

Highly engaged mobile users interested in gambling and sports content

For affiliates aiming to grow, test creatives, or capture their first wave of mobile users, In-App provides a level of volume and reach that’s hard to match with any other channel.

ASO

The 2nd major entry point into Mexico’s mobile traffic ecosystem, ASO, keeps growing in importance. According to ASOWorld, the mobile app market in Mexico reached $2.3 billion in 2023 and continues to expand alongside smartphone adoption.

The strength of ASO in Mexico comes from how much users rely on the store itself. Most searches for entertainment, bonuses, casinos, or betting start directly in Google Play. Users type queries like “Casino dinero real,” “Casino y Apuestas,” “Casino Online México,” or “apuestas deportivas México.” If an app listing is optimized for these keywords, the store can deliver free organic installs on its own.

On Android, affiliates can experiment with semantic variations, test keyword combinations, and capture traffic across related searches. With strong optimization, ASO can generate 30–40% of installs organically, meaning up to a third of your traffic comes free, reducing reliance on paid campaigns and improving overall ROI.

But ASO isn’t just about installs—retention is key in iGaming. Optimized screenshots and copy that explain bonus mechanics, highlight familiar games, and showcase an easy onboarding flow help improve 1st- and 7th-day retention.

ASO works in Mexico because it’s a mobile-first market where journeys often start in search, not ads. Affiliates who adapt their apps to local search behavior can gain a steady stream of organic installs, lower acquisition costs, and stronger retention without constantly paying for traffic.

Why it makes sense to enter Mexico with PIN-UP Partners

Success in a market like Mexico requires a reliable partner — someone experienced with multiple traffic sources and with a proven track record with affiliates.

PIN-UP Partners, both an affiliate program and a direct advertiser, has been active in LatAm for years. They know how to build traffic flows that generate real profit, supporting scaling across any traffic source. What matters most is quality traffic and a clear focus on hitting performance goals.

For more insights, check out the recent interview with Oleksandr Hloza, Team Lead Affiliate, where he explains how PIN-UP approaches traffic payback windows and why maintaining positive ROI for partners is always the priority, not just chasing volume.

Affiliates looking to enter one of the most promising iGaming markets in a structured, results-driven way can contact their PIN-UP Partners manager or sign up on the website.

Delivering fresh updates on casino traffic trends, regional market highlights, practical guides for iGaming operators and affiliates—everything to stay informed and grow in the iGaming space. With a Bachelor's degree in Communication, my focus is on breaking down complex topics into clear and practical content.